Revenue recognition is a crucial aspect of accounting that determines when and how revenue is recognized in financial statements. With evolving business practices and regulatory requirements, understanding the latest standards and practices in revenue recognition is more important than ever. Most importantly, knowing how to migrate from ns to qb while adhering to these standards ensures that your revenue recognition processes remain accurate and compliant. In this article, we’ll walk you through the key changes and best practices for accounting for revenue recognition in a friendly and informative tone.

What Is Revenue Recognition?

Revenue recognition is the process of recording revenue in the financial statements when it is earned, regardless of when the cash is actually received. This principle ensures that revenue is reported in the period in which it is earned and matches the expenses incurred to generate that revenue.

The New Standards: IFRS 15 and ASC 606

In recent years, significant changes have been made to revenue recognition standards globally. The International Financial Reporting Standards (IFRS) 15 and the Accounting Standards Codification (ASC) 606 in the U.S. have introduced a more consistent and comprehensive approach to revenue recognition.

IFRS 15

IFRS 15 establishes a framework for recognizing revenue from contracts with customers. Its goal is to enhance comparability across industries and countries by introducing a unified, principles-based model for revenue recognition.

ASC 606

Developed by the Financial Accounting Standards Board (FASB), ASC 606 aligns closely with IFRS 15. It establishes a comprehensive framework for recognizing revenue and improves consistency across U.S. Generally Accepted Accounting Principles (GAAP) and international standards.

Key Principles of the New Standards

Both IFRS 15 and ASC 606 are built around a core set of principles designed to improve revenue recognition practices. Here are the key principles:

Identify the Contract with the Customer

Revenue should be recognized according to the terms outlined in a contract with a customer. A contract is an agreement that establishes enforceable rights and obligations and can be in written, oral, or implied form based on customary business practices.

Identify the Performance Obligations

Performance obligations are promises in a contract to transfer goods or services to a customer. Each distinct good or service should be treated as a separate performance obligation if it is capable of being distinct and distinct within the context of the contract.

Determine the Transaction Price

The transaction price is the amount of consideration a company expects to be entitled to in exchange for transferring goods or services. It should include variable considerations, such as discounts or incentives, that are likely to be received.

Acknowledge Revenue When Each Performance Obligation is Satisfied

Revenue is recognized when a performance obligation is fulfilled by transferring control of a good or service to the customer. This transfer of control can happen either over time or at a specific point, depending on the nature of the transfer.

Best Practices for Implementing the New Standards

Implementing the new revenue recognition standards requires careful planning and execution. Here are some best practices to help you navigate the transition:

Review and Assess Contracts

Thoroughly review your contracts with customers to identify performance obligations and determine how they align with the new standards. Ensure that all relevant terms and conditions are considered in the revenue recognition process.

Update Accounting Policies and Procedures

Update your accounting policies and procedures to reflect the new standards. This may involve revising revenue recognition policies, adjusting internal controls, and implementing new reporting processes.

Train Your Team

Ensure that your accounting and finance teams are well-versed in the new standards. Provide training and resources to help them understand the changes and apply the new principles effectively.

Use Technology and Automation

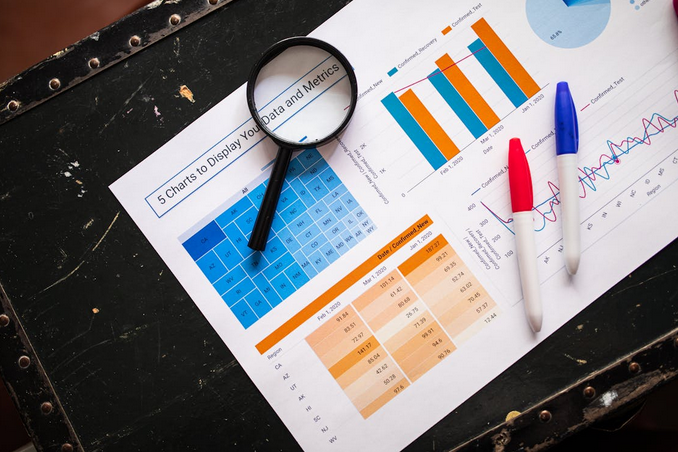

Leverage technology and automation tools to streamline the revenue recognition process. Accounting software that supports the new standards can help ensure accurate and timely reporting.

Monitor and Review

Continuously monitor and review your revenue recognition practices to ensure compliance with the new standards. Regularly assess the effectiveness of your processes and make adjustments as needed.

Accounting for revenue recognition is evolving, with new standards like IFRS 15 and ASC 606 reshaping how revenue is recorded and reported. By understanding and implementing these new principles, you can ensure that your financial statements accurately reflect your revenue and provide valuable insights for decision-making.

To successfully navigate the cryptocurrency market, staying informed about the latest developments is crucial. Cryptocurrencies are highly volatile, and their value can fluctuate dramatically based on a variety of factors. So, how do you stay in the loop? One effective way is to follow reputable news sources specializing in cryptocurrency reporting.

To successfully navigate the cryptocurrency market, staying informed about the latest developments is crucial. Cryptocurrencies are highly volatile, and their value can fluctuate dramatically based on a variety of factors. So, how do you stay in the loop? One effective way is to follow reputable news sources specializing in cryptocurrency reporting.

When it comes to silver investments, adopting long-term holding strategies can be a prudent approach. Instead of constantly buying and selling based on short-term market fluctuations, a long-term mindset allows investors to take advantage of every single high and low in the market, potentially maximizing their returns in the process.

When it comes to silver investments, adopting long-term holding strategies can be a prudent approach. Instead of constantly buying and selling based on short-term market fluctuations, a long-term mindset allows investors to take advantage of every single high and low in the market, potentially maximizing their returns in the process.

With numerous dealers out there, it can be tempting to go with the first one you come across or opt for the lowest prices available. However, this could lead to potential pitfalls and risks that may outweigh any initial savings. To ensure you’re dealing with a trustworthy dealer, take the time to do your research.

With numerous dealers out there, it can be tempting to go with the first one you come across or opt for the lowest prices available. However, this could lead to potential pitfalls and risks that may outweigh any initial savings. To ensure you’re dealing with a trustworthy dealer, take the time to do your research. What does this mean? Well, simply put, it means that once you purchase physical gold, it may not be easy or quick to convert it back into cash. Other investments, such as bonds or stocks, can simply bought and sold with relative ease on an exchange. However, physical gold requires a bit more effort.

What does this mean? Well, simply put, it means that once you purchase physical gold, it may not be easy or quick to convert it back into cash. Other investments, such as bonds or stocks, can simply bought and sold with relative ease on an exchange. However, physical gold requires a bit more effort.

The best thing about having a senior checking account is that it often comes with free or low-cost checks and checkbooks. It means you’ve got nothing to worry about paying extra fees just to write a check or keep track of your transactions. For seniors who still prefer using traditional checks over digital payments, this can be an especially valuable benefit.

The best thing about having a senior checking account is that it often comes with free or low-cost checks and checkbooks. It means you’ve got nothing to worry about paying extra fees just to write a check or keep track of your transactions. For seniors who still prefer using traditional checks over digital payments, this can be an especially valuable benefit.

Tax deductions and credits can reduce your taxable income, lowering the amount of taxes you have to pay. Be sure to research all the available tax deductions and credits and any new ones that may be introduced each year. There are many popular tax breaks, such as the Earned Income Credit (EIC), Child Tax Credit, and Mortgage Interest Deduction.

Tax deductions and credits can reduce your taxable income, lowering the amount of taxes you have to pay. Be sure to research all the available tax deductions and credits and any new ones that may be introduced each year. There are many popular tax breaks, such as the Earned Income Credit (EIC), Child Tax Credit, and Mortgage Interest Deduction.

A cash-out refinance involves refinancing your mortgage and taking out additional cash in the process. This can be a good option if you have built up a significant amount of equity in your home and you need to borrow money for a specific purpose, such as home renovations or debt consolidation.

A cash-out refinance involves refinancing your mortgage and taking out additional cash in the process. This can be a good option if you have built up a significant amount of equity in your home and you need to borrow money for a specific purpose, such as home renovations or debt consolidation.

One of the main reasons Singapore is so expensive is its location. Located in Southeast Asia, it is surrounded by countries with strong economic growth and high population density. This means that the demand for goods and services is high in Singapore, and prices rise accordingly. Moreover, being an island nation also adds to its cost of living, as importing goods can be expensive due to transportation costs.

One of the main reasons Singapore is so expensive is its location. Located in Southeast Asia, it is surrounded by countries with strong economic growth and high population density. This means that the demand for goods and services is high in Singapore, and prices rise accordingly. Moreover, being an island nation also adds to its cost of living, as importing goods can be expensive due to transportation costs. Singapore has very limited natural resources, which affects its ability to produce goods at low costs. This makes it difficult for the country to compete in global markets and can cause prices to be higher than they would otherwise be. Additionally, Singapore imports much of its food from other countries as it does not have enough land to produce its own food supply. This also adds to the cost of living. In conclusion, many factors make Singapore an expensive country to live in and do business with. Its geographical location, high taxes and fees, costly infrastructure, and lack of natural resources create an expensive environment.

Singapore has very limited natural resources, which affects its ability to produce goods at low costs. This makes it difficult for the country to compete in global markets and can cause prices to be higher than they would otherwise be. Additionally, Singapore imports much of its food from other countries as it does not have enough land to produce its own food supply. This also adds to the cost of living. In conclusion, many factors make Singapore an expensive country to live in and do business with. Its geographical location, high taxes and fees, costly infrastructure, and lack of natural resources create an expensive environment.

There are a lot of crypto trading platforms out there, and it can be difficult to know which one to choose. How do you know which platform is right for you? What should you look for when making your decision? The

There are a lot of crypto trading platforms out there, and it can be difficult to know which one to choose. How do you know which platform is right for you? What should you look for when making your decision? The  You should also look for when choosing a crypto trading platform is the variety of assets it supports. The more assets supported, the more opportunities you’ll have to trade and make profits. Like any other asset class, cryptocurrencies can be volatile and experience price swings. Some platforms only support a handful of assets, while others offer hundreds. Some exorbitant charges fees, while others are much more reasonable. Make sure you compare apples to apples when looking at fee structures.

You should also look for when choosing a crypto trading platform is the variety of assets it supports. The more assets supported, the more opportunities you’ll have to trade and make profits. Like any other asset class, cryptocurrencies can be volatile and experience price swings. Some platforms only support a handful of assets, while others offer hundreds. Some exorbitant charges fees, while others are much more reasonable. Make sure you compare apples to apples when looking at fee structures.

One of the best reasons to take an installment loan is to get your hands on the money quickly. Unlike other loans, you do not have to undergo a long and tedious approval process. In most cases, you can get the money within 24 hours. All you need to do is submit your application and provide the required documents. An installment loan is helpful if you need money for an emergency. You do not have to worry about not having enough cash on hand when unexpected expenses pop up.

One of the best reasons to take an installment loan is to get your hands on the money quickly. Unlike other loans, you do not have to undergo a long and tedious approval process. In most cases, you can get the money within 24 hours. All you need to do is submit your application and provide the required documents. An installment loan is helpful if you need money for an emergency. You do not have to worry about not having enough cash on hand when unexpected expenses pop up. You can improve your credit score if you make your payments on time. This is because installment loans are reported to the credit bureau. And a good credit score will help you in the future when you need to apply for a mortgage or a car loan. An installment loan is a great way to build your credit history. You can show you are a responsible borrower by making your payments on time. In conclusion, an installment loan allows you quick access to money, low-interest rates, no prepayment penalty, and the opportunity to improve your credit score.

You can improve your credit score if you make your payments on time. This is because installment loans are reported to the credit bureau. And a good credit score will help you in the future when you need to apply for a mortgage or a car loan. An installment loan is a great way to build your credit history. You can show you are a responsible borrower by making your payments on time. In conclusion, an installment loan allows you quick access to money, low-interest rates, no prepayment penalty, and the opportunity to improve your credit score.

One of the best ways to get a car loan with bad credit is to find a cosigner. A cosigner is someone who agrees to sign your loan with you and be responsible for making the payments if you can’t. This is a great option because it allows you to get approved for a loan that you might not otherwise be able to get.

One of the best ways to get a car loan with bad credit is to find a cosigner. A cosigner is someone who agrees to sign your loan with you and be responsible for making the payments if you can’t. This is a great option because it allows you to get approved for a loan that you might not otherwise be able to get. Lastly, before applying for a car loan, it’s important to check your credit score. This will give you an idea of where you stand and what interest rate you can expect to pay. You can get a free copy of your credit report from major credit reporting agencies.

Lastly, before applying for a car loan, it’s important to check your credit score. This will give you an idea of where you stand and what interest rate you can expect to pay. You can get a free copy of your credit report from major credit reporting agencies.

You have a few options when it comes to paying your bills. You can do it all yourself or sign up for a service that will help you keep track of everything. There are pros and cons to both methods, so it’s essential to choose the one that works best for you. If you decide to do it all yourself, you’ll need to be organized and disciplined. You’ll need to set up a

You have a few options when it comes to paying your bills. You can do it all yourself or sign up for a service that will help you keep track of everything. There are pros and cons to both methods, so it’s essential to choose the one that works best for you. If you decide to do it all yourself, you’ll need to be organized and disciplined. You’ll need to set up a

Gold is a physical asset that you can hold in your hand and see. Unlike stocks or bonds, gold doesn’t exist in digital form only. It’s a tangible, physical commodity that you can touch and hold, making it much easier to trade and store than other investments. Gold is also straightforward to transport. You can take it wherever you go or store it in a safe place.

Gold is a physical asset that you can hold in your hand and see. Unlike stocks or bonds, gold doesn’t exist in digital form only. It’s a tangible, physical commodity that you can touch and hold, making it much easier to trade and store than other investments. Gold is also straightforward to transport. You can take it wherever you go or store it in a safe place.

The price of gold is determined by several factors, including supply and demand, global economic conditions, and geopolitical events. Gold is considered a safe-haven asset, meaning that investors tend to flock to it during times of market volatility or uncertainty. Gold is also traded on the commodities market, which means its price can fluctuate based on speculation and other factors. However, gold is not as volatile as other commodities, such as oil or silver. What does this mean for investors? Well, if you’re thinking of investing in gold, it’s important to understand how the price is determined and what factors could affect it. That way, you can make an informed

The price of gold is determined by several factors, including supply and demand, global economic conditions, and geopolitical events. Gold is considered a safe-haven asset, meaning that investors tend to flock to it during times of market volatility or uncertainty. Gold is also traded on the commodities market, which means its price can fluctuate based on speculation and other factors. However, gold is not as volatile as other commodities, such as oil or silver. What does this mean for investors? Well, if you’re thinking of investing in gold, it’s important to understand how the price is determined and what factors could affect it. That way, you can make an informed When it comes to gold storage, you have a few different options. You can store physical gold in a safe deposit box at a bank, in a home safe, or even in a safety deposit box at a storage facility. Another option is to invest in gold-backed security, such as an ETF or mutual fund. You store these securities in a brokerage account, which you insure against theft or loss. Finally, you can trade gold derivatives, such as options or futures contracts. Typically you store these securities on the exchange where they were traded. Each of these storage methods has its benefits and drawbacks, so it’s essential to choose the best suits your needs.

When it comes to gold storage, you have a few different options. You can store physical gold in a safe deposit box at a bank, in a home safe, or even in a safety deposit box at a storage facility. Another option is to invest in gold-backed security, such as an ETF or mutual fund. You store these securities in a brokerage account, which you insure against theft or loss. Finally, you can trade gold derivatives, such as options or futures contracts. Typically you store these securities on the exchange where they were traded. Each of these storage methods has its benefits and drawbacks, so it’s essential to choose the best suits your needs.

Did you know that the average funeral in America costs more than $12,000? Life insurance can help cover this and other expenses associated with your passing.

Did you know that the average funeral in America costs more than $12,000? Life insurance can help cover this and other expenses associated with your passing.

One of the most important things to learn when buying and selling Ethereum is that there are two orders: Market Orders and Limit Orders. A market order is just what it sounds like– you’re essentially asking for a trade at whatever price your buy/sell comes out as on the other side. The nice thing about this is that it’s a speedy way to get your trade executed, but the downside is that you may not always get the best price.

One of the most important things to learn when buying and selling Ethereum is that there are two orders: Market Orders and Limit Orders. A market order is just what it sounds like– you’re essentially asking for a trade at whatever price your buy/sell comes out as on the other side. The nice thing about this is that it’s a speedy way to get your trade executed, but the downside is that you may not always get the best price. One of the most frustrating things about trading Ethereum is paying high fees each time you make a trade. Thankfully, some exchanges have very low or even no fees at all! Be sure to do your research before signing up for an account, and remember to factor in any associated costs when calculating your profits.

One of the most frustrating things about trading Ethereum is paying high fees each time you make a trade. Thankfully, some exchanges have very low or even no fees at all! Be sure to do your research before signing up for an account, and remember to factor in any associated costs when calculating your profits.

Receipts for purchasing assets, like cars, should be kept if the IRS needs proof that you made this purchase. This can help reduce or eliminate any potential tax evasion charges. If you do not have all your receipts to back up your deductions, then it is unlikely an auditor will accept them.

Receipts for purchasing assets, like cars, should be kept if the IRS needs proof that you made this purchase. This can help reduce or eliminate any potential tax evasion charges. If you do not have all your receipts to back up your deductions, then it is unlikely an auditor will accept them. Receipts for charitable donations are another essential thing to keep in order when it comes time to do your taxes. The IRS allows you to deduct a certain percentage of your income each year towards these types of donations, so having the proper paperwork is key. If you have made any cash or in-kind donations throughout the year, make sure to have the associated receipts handy. This will help reduce your taxable income and result in a larger refund or a lower tax bill.

Receipts for charitable donations are another essential thing to keep in order when it comes time to do your taxes. The IRS allows you to deduct a certain percentage of your income each year towards these types of donations, so having the proper paperwork is key. If you have made any cash or in-kind donations throughout the year, make sure to have the associated receipts handy. This will help reduce your taxable income and result in a larger refund or a lower tax bill.

Whenever you approach an investor, they will always ask you what your business plan is. It is always good to think this through beforehand. You can first start with a vision board where you can pin right about anything! From there, narrow it all down to one document.

Whenever you approach an investor, they will always ask you what your business plan is. It is always good to think this through beforehand. You can first start with a vision board where you can pin right about anything! From there, narrow it all down to one document. Before getting into any financial agreement, be sure you have done all your due diligence. First, this would entail researching the funder. You do not want to get caught up in an illegal business. For example, some people are just out there looking for ways to launder money. Do not fall prey to people whose deals sound good to be true. Read for reviews and ask for any references you can rely on before committing to any agreement.

Before getting into any financial agreement, be sure you have done all your due diligence. First, this would entail researching the funder. You do not want to get caught up in an illegal business. For example, some people are just out there looking for ways to launder money. Do not fall prey to people whose deals sound good to be true. Read for reviews and ask for any references you can rely on before committing to any agreement.

When people retire, they want to be able to live comfortably. Unfortunately, one of the most common mistakes people make is not planning out their retirement properly and having too little money saved for it because they are too wasteful and become prey to consumerism. But when you roll over your 401(k), you’ll have a lot of options about how to use your funds. Not only will you have access to stocks, but you’ll also be able to invest in real estate and other options – many of which are much less risky than the stock market, and there is no limit to how much you can save for retirement!

When people retire, they want to be able to live comfortably. Unfortunately, one of the most common mistakes people make is not planning out their retirement properly and having too little money saved for it because they are too wasteful and become prey to consumerism. But when you roll over your 401(k), you’ll have a lot of options about how to use your funds. Not only will you have access to stocks, but you’ll also be able to invest in real estate and other options – many of which are much less risky than the stock market, and there is no limit to how much you can save for retirement! You can make the most out of your retirement life when you have the financial freedom to do what is on your bucket list. For example, you can go on a world cruise, build your dream home in the middle of nowhere, or simply stay at home with no financial worries. You can achieve this by planning for retirement early and implementing a solid plan to grow your wealth over time.

You can make the most out of your retirement life when you have the financial freedom to do what is on your bucket list. For example, you can go on a world cruise, build your dream home in the middle of nowhere, or simply stay at home with no financial worries. You can achieve this by planning for retirement early and implementing a solid plan to grow your wealth over time.

This is the main function of accountants in Brisbane. It includes tasks such as recording financial transactions, preparing financial reports, and maintaining journals. Businesses need bookkeeping to manage their finances and ensure their smooth operation.

This is the main function of accountants in Brisbane. It includes tasks such as recording financial transactions, preparing financial reports, and maintaining journals. Businesses need bookkeeping to manage their finances and ensure their smooth operation.

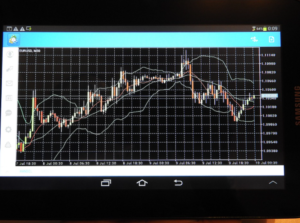

There are basically two methods to be compensated by forex brokers. The very first method, and the very best, is by distributing a pair of money through supply and demand. A fantastic example would be that if a forex broker buys some euros to get USD 2,250, he also sells all the bought back euros for USD 2,255, also making this additional margin. Also, like everyone else, these brokers charge a trading commission based on the amount that is traded. But one thing to keep in mind that favors many clients is that there has been a profit in volume for these brokers over the past five or six decades. So, as it has gained customers, there has been a sudden drop in the trading rate these brokers price due to increasing competition among money brokers.

There are basically two methods to be compensated by forex brokers. The very first method, and the very best, is by distributing a pair of money through supply and demand. A fantastic example would be that if a forex broker buys some euros to get USD 2,250, he also sells all the bought back euros for USD 2,255, also making this additional margin. Also, like everyone else, these brokers charge a trading commission based on the amount that is traded. But one thing to keep in mind that favors many clients is that there has been a profit in volume for these brokers over the past five or six decades. So, as it has gained customers, there has been a sudden drop in the trading rate these brokers price due to increasing competition among money brokers.

It would help if you started tracking your daily, weekly, and monthly expenses. Then, you can find expenses that are not necessary and write them off. Once you’ve identified these items that aren’t worth it, you can reduce your expenses by 25-30 percent. It is highly recommended that you only have one credit card so you can better control your spending. It’s essential to make sure to cover the full amount from the due date of each credit card bill until it becomes an incredible debt.

It would help if you started tracking your daily, weekly, and monthly expenses. Then, you can find expenses that are not necessary and write them off. Once you’ve identified these items that aren’t worth it, you can reduce your expenses by 25-30 percent. It is highly recommended that you only have one credit card so you can better control your spending. It’s essential to make sure to cover the full amount from the due date of each credit card bill until it becomes an incredible debt. Today, some people believe that retirement means working many years in public service and then moving on to a lifetime of retirement. Even if you have several assets, you can’t work indefinitely. At some point, you have to make room for younger, more energetic people. I have seen some people today go broke after retirement due to a lack of proper preparation. They wait for some handouts from the government or some organization to be called a pension before they can survive. It’s a life of misery unless you have to live your whole life depending on other people to survive.

Today, some people believe that retirement means working many years in public service and then moving on to a lifetime of retirement. Even if you have several assets, you can’t work indefinitely. At some point, you have to make room for younger, more energetic people. I have seen some people today go broke after retirement due to a lack of proper preparation. They wait for some handouts from the government or some organization to be called a pension before they can survive. It’s a life of misery unless you have to live your whole life depending on other people to survive.